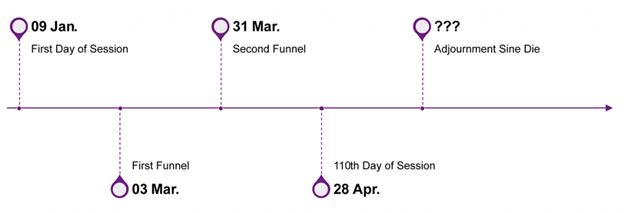

Signs of spring are all around the Capitol this week: the grass is green, the Tulip Courts have graced the presence of the Capitol, and doors in the basement of the Capitol have been propped open allowing for warm fresh air to flow through the building. Despite these signs of spring, uncertainty increases about the end of the 2023 legislative session. Just two weeks remain between today and the scheduled 110th day of session. In addition to finalizing the state budget for the fiscal year 2024, there are several major outstanding policy issues, making adjournment by April 28 unlikely.

The House was responsible for most of the activity during Week 14, including introducing a major amendment to the House Property Tax Proposal (HF 1), moving a bill related to In-Person Caucuses (HF 716), and sending a Public Assistance Oversight (SNAP) (SF 494) bill down to the Government.

Other than a resolution to extend the deadline to confirm Governor appointees beyond the April 15 deadline (SR10), the Senate has not seen floor action since March 22. The list of bills eligible for the Senate to consider continues to grow as the House gradually works through its calendar, approving bills.

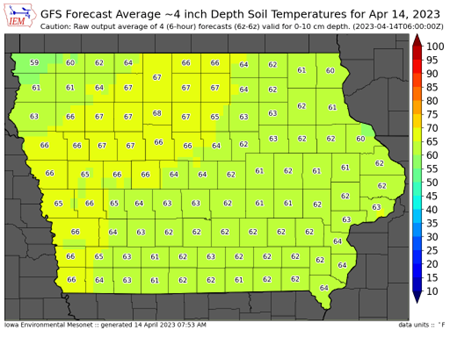

Soil Temperature

As we head into mid-April, the soil continues to warm, leaning into the 50-degree target that farmers look for when preparing to plant for the season. It is unclear whether legislators will remain in their home communities next week, allowing them to plant; both the House and Senate have scheduled committee blocks for next week, but mum’s the word on debate calendars. This may be an opportunity for leadership and budget chairs to work behind the scenes to finalize budgets.

According to Iowa State University Soil Monitoring, the current soil temperatures around the state have broken 60 degrees this week, which is ideal for planting soybeans and other crops. There is still much of the Appropriations process ahead of us, and hopefully, as the ground continues to warm so do the negotiations to get us closer to sine die.

Legislative Activity

SNAP

After four hours of debate, the bill on public assistance oversight (SF 494) passed the House on a 58-41 vote. Five Republicans (Representatives Dunwell, Lohse, Siegrist, Thomson, and Young) voted with Democrats against the bill. The bill requires new asset tests for people receiving food assistance benefits, regular eligibility checks, and computerized identity verification for Medicaid and SNAP recipients.

The asset limit is set at $15,000 liquid assets for the household and allows for one vehicle to have unlimited value, and a second vehicle to be up to $10,000 in value. If the value of the second vehicle exceeds $10,000, the amount in excess will be used to determine if the household exceeds $15,000 in liquid assets.

Democrats and a coalition of religious leaders and anti-hunger advocates argued against the bill, pointing out that fraud is low, deserving families could lose benefits, and SNAP is entirely federally funded. Advocates for food banks, social services, and religious organizations raised concerns at the subcommittee hearing for the bill. Democrats ran 18 amendments on the floor, all of which failed.

The bill now goes to the desk of Governor Reynolds, who is expected to sign it.

In-Person Caucuses

A bill requiring precinct caucuses to be conducted in person moved out of the House Ways and Means Committee Thursday. Additionally, the bill requires voters to register with a party 70 days before caucus night to be allowed to attend and participate. Currently, Iowans can register to vote and/or change their party registration the night of the caucus. Legislators engaged in a heated discussion in subcommittee and committee about the rights of each party to decide how their caucuses are run. Since caucuses are party events, they have different rules and requirements than elections.

Iowa Democrats proposed a switch to a mail-in voting system to address the DNC’s concerns about the accessibility of caucuses in the state. Republicans, including Governor Reynolds and House Ways and Means Chair Rep. Bobby Kauffman, have stated that mail-in voting constitutes a primary, not a caucus, and Iowa’s first-in-the-nation status would be at risk.

The bill now moves to the House floor for debate.

Weapons Omnibus

A bill about weapons allowed in locked vehicles in parking lots of public K-12 schools and state universities has cleared the House on a 62-37 vote. Republican Representative Ingels and Representative Mohr voted with Democrats against the bill. The bill has been introduced each year for several years. The language specifies that anyone who may legally carry a weapon can leave a gun out of sight in a locked vehicle. Business groups objected to having the policy apply to the private sector and the bill was changed so it does not apply to businesses. HF 654 also prohibits insurance companies from refusing to insure Iowa schools that have armed staff on school grounds. Additionally, the bill would make it mandatory for Iowa public schools to make age-appropriate gun safety courses available to all students in grades 7-12. The program outlined in the bill is the Eddie Eagle program, which comes from the National Rifle Association.

Critics of the bill say this change will put Iowa children at greater risk of school shootings, making weapons legal on campuses where mass shootings continue to threaten teachers and students. During a heated debate, Representative Lindsay James cited a report from the Center for Disease Control that found guns are the second-leading cause of death for Iowa youth. Representative Rick Olson and Representative Steven Holt went back and forth about the definitions of “dangerous weapons” and “offensive weapons.”

The bill now moves to the Senate for consideration of the bill as amended by the House.

Tax Reform Activity

The hotly anticipated Property Tax Reform amendment was introduced this week and approved unanimously by House Way and Means on Thursday (25-0).

The amendment strikes the entire bill and replaces it with four divisions related to transparency in taxation:

| School Foundation Property Tax | Reduce the $5.40 levy by $1.00 (state takes over $204 million). |

| Property Tax Limitation | Reduces the amount of property taxes due if they exceed 103% (Residential, Agricultural) or 108% (Commercial, Industrial) of the prior year. |

| Local Government Budgets | Requires increased notice to taxpayers. |

| Bond Elections | Moves all elections for bonding to the general election date. |

The bill would cap property tax increases on Iowans’ homes and farms at 3% per parcel annually and put an 8% cap per parcel on increases for commercial and industrial properties. The bill would also lower the school foundation property tax rate of $5.40 for every $1,000 of taxable valuation to $4.40, with the state taking over the $204 million loss of revenue caused by the levy reduction.

Republicans and Democrats alike expressed support for the bill, which they say offers certainty for Iowans who are experiencing huge increases in their property’s assessed value. County assessors have found that residential property assessments have jumped over 20% on average around the state. It is not known whether or not these provisions have been agreed upon by both Ways and Means Chairs.

As previewed at the beginning of the session, both chambers forecasted Property Tax Reform as a major priority this session, to lower property taxes and make the system more transparent for taxpayers. During the first four weeks of session, both chambers introduced their respective proposals on Property Tax Reform. In Week 2 the House introduced HF1, and shortly thereafter the Senate introduced two Tax bills, Property Taxes (SF356) and Sales Tax (SF550).

Before chambers could turn their attention to comprehensive tax reform, they needed to address a tax fix: SF181, a measure fixing a state mistake related to residential valuations, was passed by both chambers in February and signed by the Governor on February 20. Since then, conversations related to taxes and property tax reform stalled.

Hopefully, this amendment jumpstarts conversations related to Property Tax Reform and in the coming weeks, Senator Dan Dawson and Representative Bobby Kauffman can work together to develop comprehensive reform to send to the Governor, which may be key to getting out of this session.

Judicial Branch Update

Abortion Rights

A 2018 law blocked by the Polk County District Court is being reconsidered by the Iowa Supreme Court this summer. The law attempted to ban abortion after the detection of embryotic cardiac activity (usually around six weeks) and was signed by Governor Kim Reynolds. The Court blocked the legislation from taking effect because of conflict with the Iowa Constitution and federal abortion laws (before the overturn of Roe v. Wade at the federal level last summer).

Lawyers for Planned Parenthood and the ACLU of Iowa made their cases this week in oral arguments before the Iowa Supreme Court. In a statement, Ruth Richardson, president, and CEO of Planned Parenthood North Central States said, “If this 2018 law is resurrected, it would block about 98% of abortions in Iowa, forcing people to travel out of state, to self-manage their abortions outside of the medical system, or be forced into pregnancy and birth.”

Abortion is currently legal in Iowa up to 20 weeks of pregnancy. If the Court allows the law to take effect, the Republican-led legislature may extend the legislative session to attempt to codify the decision.

Budget Update

This week provided no significant update on appropriations or any indication that we are on the cusp of budget negotiations. Senate Republicans still have yet to release their budget targets. The shell bills that passed Senate Appropriations Committee during Week 13 are on the Senate calendar and will be amended on the floor with numbers when determined by appropriations chairs and leadership.

As a reminder, the House proposes spending $8.58 billion in FY 2024, an increase of 4.5% from the current year. This proposal is about $90 million more than the Governor’s budget and the Senate GOP’s proposed budget of $8.486 billion for FY2024.

| Budget | House | Senate | Status |

| Admin & Reg | SF 557 (SSB1209) | 04/03/2023 Committee report approving bill, renumbered. | |

| Ag & Natural Resources | SF 558 (SSB1210) | 04/03/2023 Committee report approving bill, renumbered. | |

| EcoDevo | SF 559 (SSB1211) | 04/03/2023 Committee report approving bill, renumbered. | |

| Education | SF 560 (SSB1212) | 04/03/2023 Committee report approving bill, renumbered. | |

| HHS / Veterans | SF 561 (SSB1213) | 04/04/2023 Committee report approving bill, renumbered. | |

| Infrastructure | |||

| Justice System | SF 562 (SSB1214) | 04/04/2023 Committee report approving bill, renumbered. | |

| Judicial Branch | SF 563 (SSB1215) | 04/04/2023 Committee report approving bill, renumbered. | |

| Transportation |

Bills Signed by Governor

At the end of Week 14, 33 bills have been enrolled and sent down to the Governor, thirteen of these await her signature. Twenty bills and resolutions have been signed into law by the Governor to date. A complete list of enrolled bills and enactment dates can be found here.

| Bill | Description | Signed by the Governor |

| HF 68 | Establishing an Educational Savings Account Program in Iowa | 1/24/2023 |

| SF 192 | Establishing SSA (School Supplemental Aid) for FY 2024 | 2/7/2023 |

| SF 153 | Single-trip permits for a vehicle of excessive size in emergencies | 2/15/2023 |

| HF 161 | Limitations on damages in medical malpractice | 2/16/2023 |

| SF 181 | Property tax calculation fix for residential assessments | 2/20/2023 |

| HF 113 | Child welfare representation | 03/22/2023 |

| HF 133 | Voluntary debt cancellation notice | 03/22/2023 |

| HF 202 | Makes it a serious misdemeanor to use fire, destructive devices, or explosives recklessly to endanger property or safety. | 03/22/2023 |

| HF 205 | Barrel tax revenues collected on beer | 03/22/2023 |

| HF 257 | Strikes the current list of third-party CDL testers and authorizes the DOT to adopt rules restricting the scope of third-party testers. | 03/22/2023 |

| HF 337 | Allows the use of any federally approved refrigerant so long as the refrigerant is used according to federal safety standards. | 03/22/2023 |

| SF 154 | Adds specified hydro-excavation equipment to the list of vehicles exempt from size, weight, load, and permit requirements. | 03/22/2023 |

| SF 157 | Authorizes certain persons to administer the final field test of an approved driver education course. | 03/22/2023 |

| SF 482 | Prohibits a person from using a toilet that does not correspond to the person’s biological sex in K-12 schools. | 03/22/2023 |

| SF 75 | Affects ambulatory surgical centers and rural emergency hospitals. | 03/28/2023 |

| SF 262 | Creates consumer data protections and provides civil penalties. | 03/28/2023 |

What is next?

As mentioned last week, budget season is upon us. Even if there is not a flurry of activity on the floor or in committee rooms next week, we can hope that leaders and committee chairs are working behind the scenes to dial-in budget targets and final numbers.

The same bill eligibility rules apply for floor debate next week as they did this week (Week 14) and will be that way for the rest of session. Only the following bills will be considered on the House or Senate floor (along with a few unique and rare exceptions):

• Bills passed by both Houses

• Appropriations Bills

• Ways and Means Bills

• Unfinished Business

Additionally, amendments no longer need to be filed on the day preceding floor debate.

Two weeks left in regulation— Tax reform, pipelines, and budgets…oh my. A lot of issues to resolve in the coming weeks leading up to and likely beyond the scheduled 110th Day of Session on April 28.

The full 2023 Session Timetable can be found here.