The excitement around basketball was palpable in the Capitol this week. The Drake Bulldogs, Iowa Hawkeyes, and Iowa State Cyclones are all sending their men’s and women’s teams into the first round of the NCAA tournament. The Dentons Davis Brown Government Relations team has Drake alumni, bleeds blue, and is proud of the Drake Men’s and Women’s teams for clinching their spots in their respective brackets. Des Moines and Drake University host the first and second rounds of the NCAA Division 1 men’s basketball tournament at Wells Fargo Arena. The Senate canceled all committees and debates on Thursday, and the House entertained a light schedule, as March Madness begins.

Even before the end-of-week excitement, the legislature had a lighter week in week 10. The chambers continue committee and floor work as we head toward the second funnel, but subcommittees are fewer and farther between with a great deal of focus placed on legislative priorities in the full chamber.

Bills Sent to the Governor

Once a bill passes both the House and Senate and is put on the list of “enrolled” bills, the Governor has three legislative days to sign it. Last week, the legislature sent half a dozen bills down to the Governor. Notably, the bill banning gender-affirming care for youth in Iowa has not yet been enrolled, but the Governor is expected to sign it soon.

A list of all bills enrolled in this legislative session can be found below.

Legislative Priorities

Government alignment bill passed Iowa House

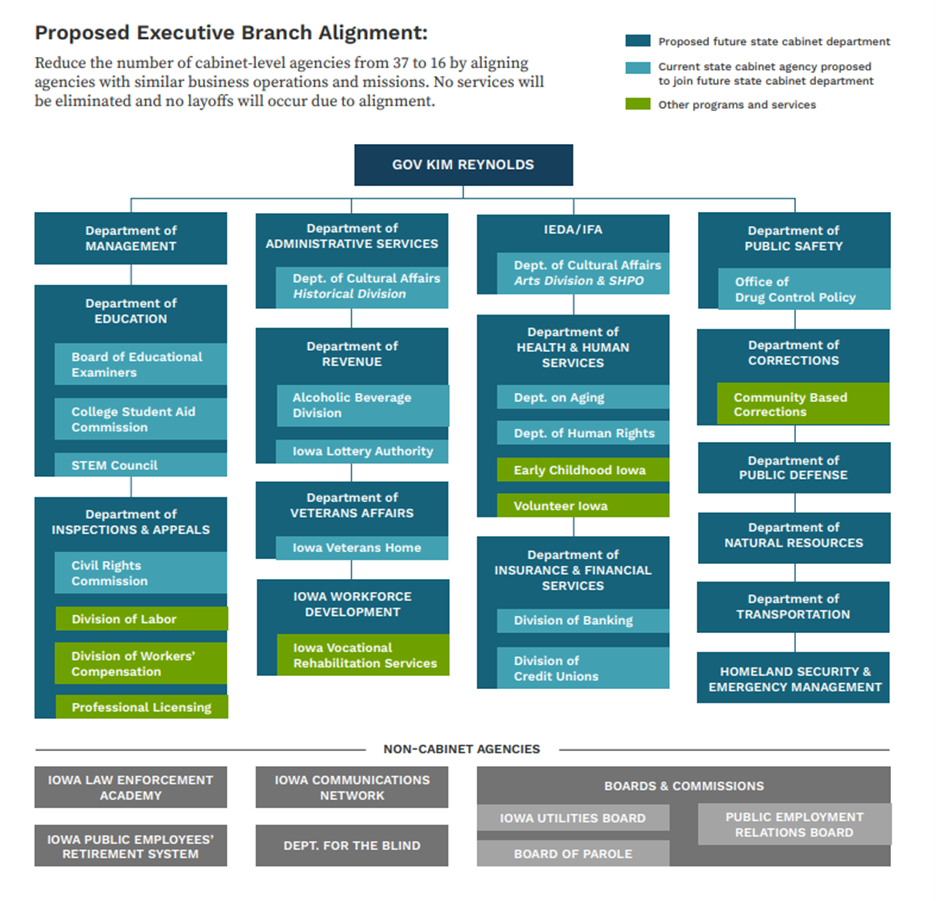

The Governor’s proposal to reorganize state government (SF514) and cut the number of departments in half passed the House on a 58-39 vote, with five Republicans voting with the Democrats against the bill (Cisneros, Dieken, Sexton, M. Thompson, and C. Thomson) and one absent (Mohr). Debate stretched through most of Wednesday, with 17 amendments filed by Democrats. None of the amendments were approved by the full House, with Republicans resistant to attempts to modify the legislation. The majority of the debate centered on the topic of the Department of the Blind. Many Democrats brought up comments from their constituents about keeping control of the Department in the hands of experts instead of the Governor’s office.

Representative Bloomingdale, who managed the bill, said that the changes were overdue and will streamline state government. She said that the bill will save the state money while allowing agencies to improve services. Democrats said that the reorganization gives the Governor too much power and ignores the voices of Iowans.

Governor Reynolds released a statement on SF 514 passing the Iowa House:

For decades, Iowans have seen state government grow beyond its means. Today, the Iowa House joined me and the Iowa Senate to declare an end to bloated bureaucracy. We are making government smaller, more efficient, and more effective. We are saving taxpayer dollars and putting Iowans’ needs first. This transformational legislation will put Iowa in the best position to help our state thrive.

Rural emergency hospitals

On Tuesday, the House sent SF 75 back to the Senate. The Senate concurred with the amendments made in the House and passed the bill unanimously. This is a priority bill of the Iowa House Republicans to ensure access to emergency care in rural areas. The bill now goes to the Governor for signature.

Tax Reform

Senator Dawson advanced his bill reforming Statewide Sales Tax (SF550) through the full Ways and Means Committee last week. The bill has numerous provisions:

| Sales Tax | Increases the sales tax to 7% as of 2025 and strikes local option sales taxes (LOST). Transfers part of the sales tax increase to local governments and requires the money to be spent according to the jurisdiction’s revenue purpose statement. (Specific requirements for Polk County; Polk County is required to use at least 75% of the money received from the fund for property tax relief.) |

| Water | Makes the water excise tax a sales tax. Increases it to the rate of the state sales tax and deposits all the funds in the general fund. |

| TIF | Authorizes the use of state sales tax in lieu of local sales taxes. Allows city ordinances using LOST revenue for urban renewal to remain in effect until repealed or expired. |

| Property Tax Exemptions | Phases in a homestead property tax exemption in place of the homestead credit. Increases the income eligibility for the Elderly/Disabled credit to 330% of the FPL. Increases the military property exemption to $4,000 by 2025. Phases on funding for the military credit. |

| Natural Resources | Scoops part of the sales tax increase for the Natural Resource and Outdoor Recreational Trust Fund, commonly referred to as Iowa’s Water & Land Legacy (IWILL). |

| Conservation | Prohibits a charitable conservation contribution credit from being claimed after 2025, except for credits being carried forward. |

| Transit | Establishes conditions under which Des Moines can impose a franchise fee of 7.5% and requires that the amount in excess of 5% be used to reduce property tax levies for regional transit. |

Most notably, this reform of the local option sales tax to a statewide tax will trigger the 3/8-cent funding IWILL or water quality and other environmentally related programs. IWILL is part of the state constitution, but when it was approved it was set up so the funding for it would not be available until the next time the state sales tax is increased. At that time, IWILL will get 3/8 of a cent of the increased tax.

SF550 will need approval by the full Senate chamber before the House begins to consider its numerous provisions reforming sales tax/various property tax provisions. This bill will be in the mix during the property tax reform discussions.

In addition to the Sales Tax bill, both chambers continue to consider wholesale reform of our Property Tax system. We expect conversations related to property tax to begin in earnest now that a number of session priorities have made it through both chambers are on their way to the Governor’s desk.

| Property Tax Reform | SF 356 Passed Ways and Means Fiscal Note on SF356 published 3/13 | HF 1 Ways and Means bill (exception to funnel) |

The Senate also moved forward a bill (SSB1126) this week that would lower Iowa’s income tax to a 2.5% single rate by 2028; beginning in 2030, the income tax rates would be adjusted each year until the tax is eliminated provided there is sufficient revenue in the taxpayer relief fund (TRF). This bill eliminating income taxes moved through the Senate Ways and Means Committee this week (12-5) sending it to the full Senate for further consideration.

Data Privacy

Legislation on consumer data protection passed the House unanimously on Wednesday and had already passed the Senate unanimously early last Monday. The bill is ready to be enrolled and sent to the Governor. SF 262 would bolster data privacy in the state of Iowa. The US currently has no comprehensive federal legislation regulating data protection measures, so states make up a patchwork of various protections. Once signed, Iowa will be one of the first states to pass comprehensive consumer data protection.

REC

The Revenue Estimating Conference (REC) met last Friday morning for the scheduled March REC to provide the March estimate on Iowa’s revenue. The REC projected that the state will bring $9.75 billion in FY 2023 (the fiscal year that ends June 30); this would be a net revenue decrease of 0.5% from FY 2022 when the state collected $9.8 billion.

The REC also projected a continued decline into FY 2024 (which begins July 1), projecting a 1% decline which will result in about $9.65 billion in revenue.

Friday’s projection is slightly higher than the REC predicted in December; at that time they projected only $9.62 billion in revenue for FY 2023, which would be a decline of nearly 2% from the previous year.

By law, lawmakers are required to use the lower estimate from December to craft their budgets for FY 2023. Also by law, Iowa’s state budget cannot exceed 99% of state revenue each year. Governor Kim Reynolds made her budget proposal in January using the December estimate. She recommended a total appropriation of $8.48 billion for FY 2024 (more than $1 billion less than the projected revenue that year).

With the March REC/State revenue numbers agreed upon, a lawmaker can begin conversations related to the development of the FY 2024 budget.

Budget Target Announced

The first sign of budget life from the Senate Republicans, this week Senate Majority Leader Jack Whitver and Senate Appropriations Chair Tim Kraayenbrink released the overall budget target by Senate Republicans for FY 2024. Senate Republicans plan to spend $8.486 billion in FY 2024.

“This budget target ensures the tax cuts implemented last year are sustainable,” said Senator Whitver. “Iowa has increased funding for K-12 schools every year, it has an ongoing surplus, and incomes taxes are falling every year for Iowans, including the elimination of the tax on retirement income this year. All of these accomplishments are possible because Senate Republicans have led on conservative budgets and tax relief for hardworking Iowans,” continued Whitver. “Our tax reforms are working. Last week, revenue estimates showed Iowa continues to be in the strongest fiscal position the state has ever been. That fiscal strength creates opportunities for more tax relief in future years.”

The target is the same amount Governor Kim Reynolds released in her budget earlier this year. It represents a 3.3% increase in state spending. Over the coming weeks, Senate Appropriation Subcommittees will work to develop budgets to fund priorities in state government and meet the target of $8.486 billion.

Executive Branch Update

At the end of last week, Gov. Kim Reynolds and the Iowa Economic Development Authority (IEDA) announced $26.88 million in grant funding through the final round of Destination Iowa, a $100 million investment in quality of life and tourism attractions. In recognition of high interest in the program, Gov. Reynolds also announced an additional investment of $15 million to fund Destination Iowa applications from rural communities that did not receive grants in previous rounds.

In all, Destination Iowa awards were granted to 46 projects totaling $115 million which activated $480,265,783 in total investment.

“Destination Iowa has inspired communities in all corners of the state to dream big about projects that will bolster quality of life and attract newcomers,” Gov. Reynolds said. “The demand is so high, especially in rural areas, that I’ve extended the program to help more rural communities realize those dreams.”

Other News

Board of Regents President Michael Richards announce that Iowa’s three public universities have been ordered to review all diversity, equity, and inclusion efforts and stop any new DEI programs. A “comprehensive study and review” will be conducted over the next few months. The moratorium mirrors efforts in the state house to prohibit state universities from spending any state moneys or private funds on a DEI office or administrator (HF 616). The bill survived the first funnel but has not moved to the House floor.

Bills Signed by the Governor (as of 3/16/2023)

Fourteen bills have been enrolled and sent down to the Governor, nine of these await her signature. Five bills have been signed into law by the Governor to date.

| HF 68 | Establishing an Educational Savings Account program in Iowa | Signed by Governor. H.J. 177. | 1/24/2023 |

| SF 192 | Establishing SSA (School Supplemental Aid) for FY 2024 | Signed by Governor. S.J. 279. | 2/7/2023 |

| SF 153 | Single-trip permits for a vehicle of excessive size in emergency situations | Signed by Governor. S.J. 354. | 2/15/2023 |

| HF 161 | Limitations on damages in medical malpractice | Signed by Governor. H.J. 373. | 2/16/2023 |

| SF 181 | Property tax calculation fix for residential assessments | Signed by Governor. S.J. 376. | 2/20/2023 |

What’s next?

Week 11 will bring more floor action and committee work is expected to ramp up, with just two weeks left until the second funnel on March 31.

Now with the Government Alignment bill (SF514) complete, the March REC/State revenue numbers agreed upon, as well as the release of the overall Senate budget target, we can also expect negotiations on a property tax reform plan and conversations related to the development of the FY 2024 budget to begin in earnest. Budgets will look much different than previous years, as all of the budget bills will reflect the new Government Alignment (funding 16 departments in lieu of 37); logistically, this may pose some hurdles for LSA drafters/fiscal analysts as they retool all of the budget documents and bills.

The full 2023 Session Timetable can be found here.