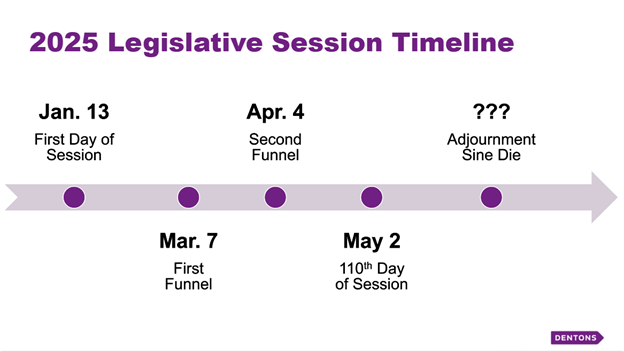

Friday, March 7 marked the first funnel deadline for the 2025 Iowa legislative session. By midnight, policy bills had to be passed by a committee in its originating chamber to remain eligible for consideration this year. Notably, this “funnel” deadline does not apply to appropriations bills, ways and means bills, and leadership bills. The goal of the funnel is to narrow the focus of legislative priorities.

Funnel Week Recap

This year is on track to be a record-breaking year in terms of bill introductions with the total number – including successor bills and joint resolutions – nearing 3,000. Introductions of “funnel-proof” bills will continue in the coming weeks. It is anticipated there will be numerous bill introductions for policies that will be dead on arrival (bills introduced and referred to committees they cannot pass through due to the funnel deadline). However, these bills may be eligible for consideration next year, the second year of the General Assembly.

Committee agendas were extensive as committee chairs sought to pass many bills through the funnel deadline and keep priorities alive. Over 200 bills passed through committees in their originating chamber last week alone. These bills will be eligible for floor debate after being renumbered and reintroduced.

The focus of the coming weeks will be advancing bills through the full chambers so they can be assigned and considered in the opposite chamber before the second funnel deadline in four weeks on April 4.

Major Property Tax Legislation Released

Heading into session, property taxes were consistently named as a top priority by all members of leadership in the House and Senate. Late last week, the long-anticipated property tax legislation was released in both the House by Representative Bobby Kaufmann and in the Senate by Senator Dan Dawson, the chairs of the Ways and Means Committees in their respective chambers. HSB 313 and SSB 1208 represent the largest overhaul of the property tax process since the 1970s. High-level highlights of the bill include:

- Phasing out rollbacks over a five-year period

- Implementing 2% revenue restrictions

- Establishing a uniform foundation levy of $2.97 while cutting property taxes by $400 million

- Streamlining the school funding formula

- Increasing the homestead exemption to $25,000

Overall, the stated purpose of the Property Tax Reform plan is to seek to make the property tax process more transparent, fair, and predictable. Senator Dawson told press on Thursday, “We want to give a system to Iowans that actually works for Iowans in the end.” Both Chairs expressed that there will be time for feedback and amendments before these bills move through the legislative process to give plenty of time for input from key stakeholders.

In laying out his initial reaction to the proposal the Democrat ranking member of the House Ways and Means Committee, Representative Dave Jacoby stated, “Iowans should be extremely skeptical about the GOP’s latest property tax plan,” and that, “House Democrats believe we need to put money back in the pockets of homeowners and renters immediately.” Representative Jacoby’s response shows there is bipartisan consensus on property tax reform, however, it remains to be seen if the two parties will work together this session on the issue.

Governor Reynolds’ Major Legislative Priorities Update

Alongside individual, committee, and department bills, Governor Kim Reynolds advanced several major priorities through the first funnel deadline.

- Healthcare: The Governor’s healthcare bill passed through committee in the House and was reintroduced in the House (HF 754) and referred to Appropriations. The Senate has yet to renumber SSB 1163, which passed committee on the March 5.

- Childcare: The bills relating to childcare passed through committee and were renumbered as SF 445 and HF 623 last week. This bill establishes a pilot program for childcare continuum partnership grants is established to support full-day early childhood education and care programming.

- Energy: Governor Reynolds’ energy bills, which include a frequent legislative topic related to the right-of-first refusal impacting energy transmission entities, passed the House Commerce Committee in mid-February with an amendment. The House bill was renumbered as HF 834, and referred to Ways and Means today, March 7. The Senate passed SSB 1112 through the Commerce Committee during funnel week so the bill survived the funnel in both chambers.

- Unemployment Insurance Reform: SF 504 is the amended version of the Governor’s unemployment insurance reform bill, which passed through Workforce and was referred to Ways and Means after being renumbered. The House version did not survive the first funnel.

- Hands-Free Driving: SF 22, which prohibits the use of cell phones while driving, passed through committee in mid-February. The House version passed committee on the same timeline, but it was renumbered as HF 827 on Thursday.

- Math Education Reform: SF 450 and HF 784 both reform Iowa’s math education for K-12 students. Civics provisions in both bills were removed in committee, but the math provisions survived the funnel and were reintroduced in their respective chambers.

- Cell Phones in Schools: HF 782 and SF 370 are the renumbered versions of the bills introduced by Governor Reynolds to ban the use of cell phones during instructional time in school settings. Both bills were placed on the calendar and are eligible for floor debate.

- Paid Family Leave: HF 889 was reintroduced on the Friday of funnel week after passing through the House State Government Committee in early February. The Senate version did not pass through the first funnel.

- Disaster Preparedness: As a priority introduced in Week 7, HSB 246 and SSB 1188 quickly made their way through committee and survived the first funnel.

What’s next?

The second funnel deadline for the 2025 legislative session is April 4. Bills must pass through committee in the opposite chamber from which they originated. Again, appropriations, ways and means, and administrative rules bills are “funnel-proof” and exempt from this deadline. Both chambers will spend a significant amount of time on floor work, working through debate calendars to approve priority bills and message them to the opposite chamber.

The Revenue Estimating Conference meets on Thursday, March 13, which will kick off preliminary conversations related to the development of the FY 2026 budget.

The full 2025 Session Timetable can be found here.