The Iowa legislature met its first major milestone of the 2022 legislative session. Today brings the close of the first legislative funnel. This means that for bills to remain “alive” and eligible for further action, the bills that were introduced in either chamber must be voted out of committee in its chamber of origin by the close of Friday, February 18. There are limited exceptions for appropriations, tax, and leadership bills. The majority of this week was consumed with committee action, advancing bills through full committee so they remain eligible for further consideration.

The goal of the funnel is to narrow the focus of legislative priorities. All said and done, 184 bills received committee approval during the first funnel week (for context, there were 182 bills signed into law in 2021). These bills will be reprinted and renumbered and become floor eligible in their originating chamber.

The House and Senate reached an agreement on Education funding, accepting the 2.5% School Supplemental Aid (SSA) level proposed by the House and Governor Reynolds. The Senate approved the House version of the SSA bill HF2316, increasing school funding by $159 million (2.5% per pupil). The bill passed the Senate 31-17 on Monday and sent the bill down to the Governor for her signature.

HF2316 was the first bill signed into law of the 2022 legislative session. Governor Reynolds signed the SSA on Thursday, February 17–this is typically the first bill signed into law each session. Governor Reynolds issued the following statement after the bill signing:

Providing a quality education for the next generation of Iowans is one of our most important responsibilities,” stated Gov. Reynolds. “The state’s significant and responsible funding increases year-over-year for more than a decade helps ensure that Iowa has the strong public education system necessary to support the success of our students and our state.

Fifty-six percent of Iowa’s entire budget funds public education. In fiscal year (FY) 2023, which begins July 1, 2022, that’s more than $3.6 billion. Eighty percent of the education budget goes to K-12 schools, including more than $3.5 billion for state foundation school aid and nearly $29.5 million for transportation equity.

Tax Update

On Monday, the House held a public hearing on their House Tax Plan HF2317. The House proposal includes a phased-in 4% flat income tax and the elimination of retirement income tax. The plan does not include a cut to the corporate tax rate, like Governor Reynolds and the Senate proposed. It also does not make the local option sales tax a statewide tax nor does it make the Senate’s proposed changes to the Taxpayer Relief Fund.

The House took up their Tax Plan HF2317 on the floor on Tuesday afternoon. After a short debate that included discussion on seven amendments proposed by Democrats, the bill passed the House 61-37 with three Democrats voting for the bill.

The impact in FY 2023 is expected to be about $216 million, with $180 million of that coming from the tax exemption for retirement income. By FY 2028, the bill is expected to reduce revenues by about $1.6 billion.

House Republican leaders moved the bill forward during funnel week in an attempt to start conversations with the Senate about the final tax plan. The Senate Ways and Means Committee has approved the Senate Tax Plan SF2206 and it is now eligible for floor debate. On Wednesday, a Fiscal Note was published that provides an in-depth review of the impact of the Senate Tax Plan.

The House Tax Plan HF2317 has been received by the Senate and has been “attached” (a procedural term meaning the bills are related) to the Senate Tax Plan. The coming weeks will bring negotiations on a final tax plan.

Budget Update

On Tuesday, Senate Republicans released overall budget targets for FY 2023, with a target set at $8.202 billion, the same target as Governor Reynolds. This is a 3.5% increase in spending ($283 million), including $159 million for K-12 schools and $71.2 million for mental health funding. The projected ending balance would amount to $914 million, with $900 million in reserves and almost $2 billion in the Taxpayer Relief Fund.

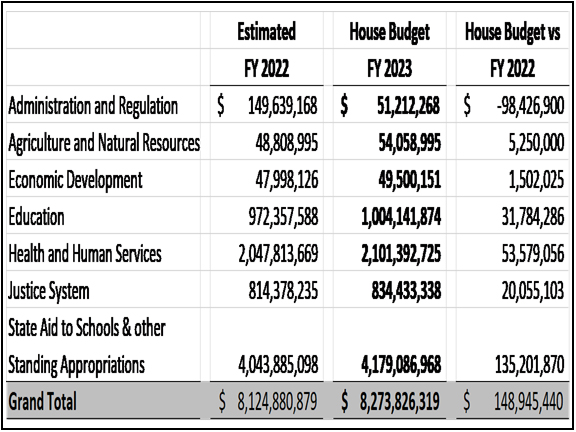

On Thursday, House Republicans released their budget plan for FY2023. The House proposed an $8.125 billion budget for FY 2023, a 1.83% increase in spending (about $77 million below the Governor and Senate proposed budget target). Included in the $8.125 million is $2.1 billion for Health and Human Services and a $20 million increase to the Justice Systems budget. Below, find a chart that was included in the House Republican Press Release that details budget targets for each budget subcommittee:

Also this week, there were additional introductions of Governor budget bills. Announcements of targets and introduction of Governor budget proposals are both signals that appropriations work will likely begin much sooner than in previous years.

Additional Policy Highlights

Major bills meeting the funnel deadline this week:

- Governor’s Workforce Bills (SSB3123/HSB682)

- Transgender Sports (SF2416)

- Transgender Sports II (SF2342)

- Medical Freedom Act (HSB647)

- Vaccine Consent (SF2343)

- Bottle Bill Changes (HSB709)

What’s next?

The focus of the next few weeks will be advancing bills through the full chambers so they can be assigned and considered in the opposite chamber before the second funnel on March 18. Floor debate will consume the next few weeks. We can also expect negotiations on a final tax plan and development and negotiations of the FY 2023 budget.