The headline of week three: tax, tax, tax – both the Senate and the House introduced their tax proposals this week. Also this week, two notable trends continued to develop and emerge:

- There was a decrease in new bills being introduced as compared with past sessions (172 bills were introduced this week)

- Committee work is being conducted earlier in session at a rapid pace (124 bills were heard in subcommittee meetings this week and over 50 bills advanced through committees this week and will be eligible for debate next week)

Behind the scenes, House and Senate leadership teams are reportedly close to reaching joint budget targets. If this happens, it would be much earlier than in year’s past as policymakers typically wait for the March Revenue Estimating Conference (REC) to begin budget discussions in earnest. This year, House and Senate leaders are anticipating that the March REC will not be materially different from the December REC and that they can begin working on the budget now.

Policy Development Highlights

Tax Reform

Senate Republicans released their tax plan this week, SSB3074 was officially introduced on Thursday. The centerpiece of the proposal is a 3.6% flat personal income tax phased in over six years. Last Wednesday the Governor introduced her tax plan (HSB551/SSB3044) which includes a 4% flat personal income tax phased in over four years. Both plans include similar provisions addressing corporate tax rates and retirement income taxation. The Senate plan makes the local option sales tax statewide and includes full funding for Iowa’s Water Land and Legacy trust.

Majority Leader, Senator Jack Whitver, said the state had a complicated tax code prior to 2018 but the Senate Proposal “will dramatically cut taxes in Iowa. This bill is complementary to the governor’s bill and includes many of the same concepts and goals.”

Other highlights of the Senate proposal include:

- Flat 7.8% corporate rate

- Elimination of taxes on retirement income and expanded pay exemptions for National Guard members

- Exemption for either cash rent or farm crop shares for farmers

- Directs that the Taxpayer Relief Fund become the Income Tax Elimination Fund, to be used to reduce and eventually eliminate the income tax in Iowa

House Republicans released their tax plan on Thursday (HSB626). The plan differs from both the Governor’s and the Senate’s proposals. The House proposal reduced the individual income tax to a flat rate of 4% phased in over four years, like the Governor. Like the Governor and Senate proposals, it also eliminates retirement income. However, the proposal does not include a cut in the corporate tax rate as Governor Reynolds and the Senate Republicans have proposed. It also does not make the local option sales tax a statewide tax nor does it make changes to the Taxpayer Relief Fund in the manner proposed by the Senate.

Now that all three tax bills have been released, this sets the table for negotiations to begin on a final 2022 comprehensive tax reform package.

Renewable Fuels

The House Ways and Means Committee acted swiftly this week as the Governor’s Renewable Fuels bill (HF2128) was introduced Monday, passed out of subcommittee Monday, passed out of full committee on Wednesday, and is now eligible for floor debate. HF2128 is designed to make renewable fuels more available to consumers. Despite the quick work in the House, there is currently not a companion bill moving through the Senate and the Senate leadership has not indicated as to when or if the Senate Ways and Means Committee will act on this.

Cybersecurity

Earlier this session, HSB534 was heard and passed out of subcommittee. The bill makes cybersecurity an essential corporate purpose for counties and cities allowing it to be treated similar to the building of roads and other critical infrastructure. A number of other cybersecurity measures are expected to be introduced soon as Iowa policymakers seek to address this growing threat to our state. Experts in the cybersecurity field presented to the House Information Technology Committee on the threats posed and actions that could be taken to address those threats.

What’s next?

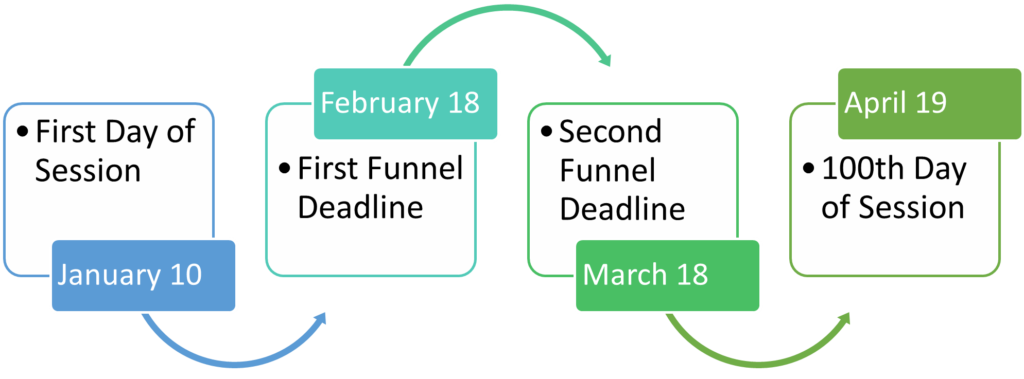

Next week will bring more committee action (the first legislative funnel deadline is February 18), negotiations on a final comprehensive tax reform package, and earnest efforts on a potential passage of the Supplemental State Aid (SSA) budget bill.