Week 2 of the legislative session was shortened by the MLK Jr. holiday weekend as well as travel difficulties caused by the weekend winter storm. Bill introductions continue to ramp up, with 152 bills introduced this week (for a total of 301 bills between the two chambers so far this session). Legislators who have bill requests need to have those filed by Friday, January 21, as this is the final day for individual senator and representative requests for bill and joint resolution drafts.

Committees have organized quickly and are already taking action on bills; just over a dozen bills have already moved through subcommittees and passed full committees. This pace was forecasted by leadership at the outset of the legislative session, as they encouraged the bodies to get their work done quickly so attention could be focused on caucus priorities. (Majority Leaders Windschitl concluded his opening day remarks by stating they should have business for this session concluded in 90 days or less.)

The most significant bills introduced this week were the Governor’s tax plan (HSB551/SSB3044) and the Employer Vaccine Mandate bill (HF 2067).

Governor’s Tax Plan

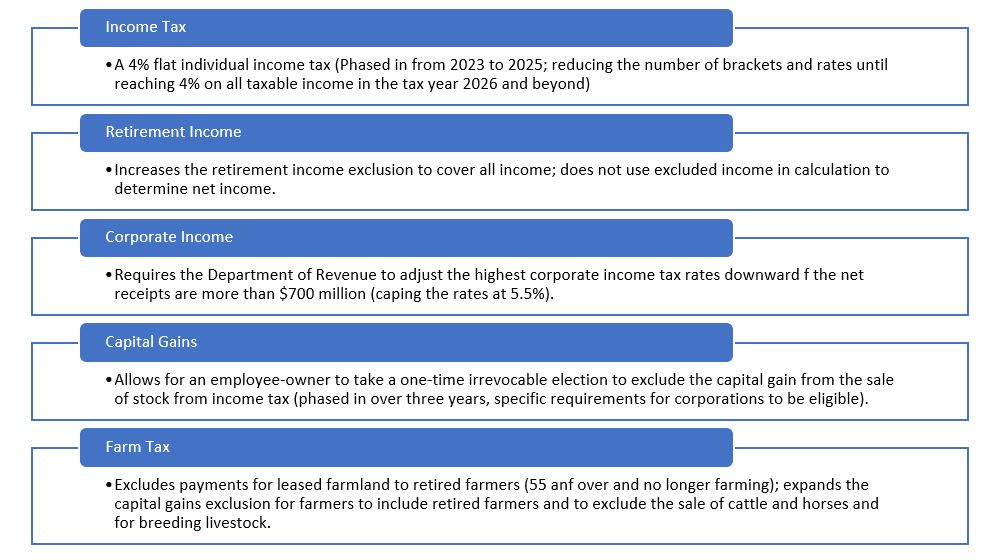

The Governor’s Tax Plan was introduced on Wednesday. As outlined in her Condition of the State, the Governor’s Tax Plan includes:

Neither the House nor Senate Ways & Means Committees have scheduled subcommittees on these bills yet. It is anticipated that the Senate tax bill will be introduced in the coming weeks. This will set the table for negotiations about the direction that will be taken on comprehensive tax reform, the top legislative priority for Republican leaders and the Governor.

Employer Vaccine Mandate

On Thursday, the House introduced HF2067 sponsored by 28 Republican legislators that would prohibit employers from requiring employees or applicants from having to take a vaccine that has not been approved by the United States FDA. This bill is an extension of the Covid Vaccine Exemptions bill (HF902) that became law last year during the second of two special sessions in October. At this time, there is no Senate companion bill.

Executive Branch Update

On Thursday, Governor Reynolds announced more than $500,000 in grants for broadband expansion and housing programs will be awarded to 38 projects in rural communities through the Empower Rural Iowa Initiative. The grants are granted through the Iowa Economic Development Authority.

Governor Reynolds release states, “The Empower Rural Iowa Initiative has played a key role in transforming our rural communities by expanding broadband access and affordable housing options, which are essential to the growth and retention of our state. These programs help turn innovative ideas into reality for small communities across Iowa, paving the way for opportunity and prosperity for generations to come.”

What is next?

Neither chamber will meet in a gavel-in session tomorrow. Next week will bring more committee action, further discussion on the tax policy (potential introduction of the Senate tax bill), and work on the first budget bill of this (and every) legislative session, the Supplemental State Aid (SSA) bill (Governor Reynolds has proposed a 2.5% increase for K-12 education).