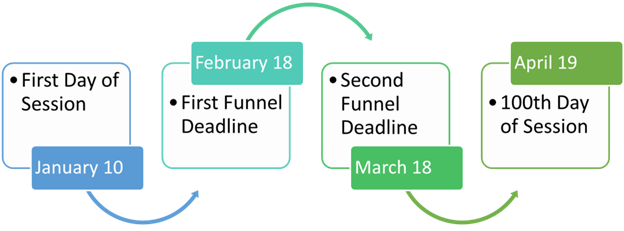

With the end of Week Nine, we are official beyond the halfway point of the scheduled legislative session. This week also marks one week until the second legislative funnel, which is scheduled for next Friday, March 18. There were many notable highlights of this week, both under the dome and across Iowa.

Tornadoes

On Saturday, Iowa saw the deadliest tornadoes in Iowa since 2008. Multiple tornadoes, ranging from EF-2 to EF-4 tornadoes, devastated 10 Iowa counties. An EF-4 tornado ripped through Winterset, killing six people; another person was killed in Lucas County.

Governor Reynolds said,

“Our hearts go out to all those affected by the deadly storms that tore through our state today. Kevin and I join with Iowans in prayer for those that lost their lives and those injured. Our hearts ache during this time, but I know Iowans will step up and come together to help in this time of need– they already are.”

Over the weekend, Governor Reynolds issued a disaster proclamation for Madison County in response to the damage and deaths resulting from the tornado this Saturday. She later added Adair, Benton, Decatur, Jasper, Lucas, Polk, Tama, Warren, and Wayne counties to the disaster proclamation. The proclamation allows for the use of state resources to help with the clean-up and for residents to access emergency management assistance.

East High School

Monday as schools were dismissing around the metro, there was a shooting at East High School in Des Moines that left one teenager dead and two wounded.

Governor Reynolds released a statement.

“I’m praying for the victims of this senseless act of violence,” she said. “I am heartbroken for the families and the pain felt across the entire community.”

Representative Ruth Ann Gaines released a statement on behalf of House Democrats. Representative Gaines taught in the district for 40-years.

“I am heartbroken to hear about the shooting that took place at East High School in Des Moines today. A shooting on school grounds just minutes from the State Capitol has to be a wake-up call for every single lawmaker and the Governor. We cannot allow school shootings to become the norm in Iowa or the nation. As we learn more about this tragedy in the days ahead, we must possess the courage to have hard conversations and do more to keep our kids and communities safe. My House Democratic colleagues and I are sending our healing and prayers to those impacted by today’s tragedy.”

Senator Nate Boulton, whose district includes East High, released the following statement:

“Members, I have an announcement that truly breaks my heart to make this morning. A shooting outside of East Des Moines High School has left a teenager dead, two others clinging to their lives, and our community in shock. We cannot, and must not, have another day where terror, grief, anger, and fear overwhelm a school and community the way it had yesterday. My sincere sympathies go out to the families who are experiencing inexplicable pain this morning. And my deepest appreciation goes out to the law enforcement officers who reacted so quickly to make sure we had suspects in custody and off the streets to prevent further harm from occurring. This is a tragic moment. and I would ask that we take a moment, stand and join together in a few moments of silence to recognize the lives lost and changed yesterday afternoon.”

Both the House and Senate chambers observed a moment in silence on Monday afternoon and Tuesday morning.

Under the Dome

Floor action was sporadic this week, but overall, there was plenty of action as chambers work to advance bills off the floor and to the opposite chamber in advance of the funnel. Forty-one bills received approval on the floor, with five of those bills sent down to the Governor.

To survive the second funnel, bills need to receive floor approval in their originating chamber and advance through committee in the opposite chamber. All other bills will be considered ‘dead’ and will not be eligible for further consideration (not including Ways and Means bills, Appropriations bills, or leadership bills).

Tax Update

Just a week after the major tax reform was signed into law by Governor Reynolds, week nine brought the introduction of further tax reform.

Tax II – Franchise, insurance, sales tax

On Monday, Ways and Means Chair Dawson introduced (SF2372) Tax II, a tax bill related to franchise, insurance, and sales taxes. Many of these provisions were originally included in the Senate Tax Proposal introduced in week three (SF2206). The Senate Way & Means Committee approved the bill on Tuesday. The changes in the bill will result in both tax increases and tax reductions in other taxes. A Fiscal Note published on Wednesday determined the overall impact of the changes is likely to increase general fund collections. The bill includes the following changes:

| Franchise/Insurance Tax | Phases in a reduction of the franchise tax to 3.9% by the 2027 calendar year. Reduces the insurance premium tax over two years to 0.9% for the 2024 calendar year. Sales Taxes: Changes software as a service to cloud computing. |

| Strikes exemptions or adds to taxable services | Web hosting and related services subject to the sales tax, except when furnished exclusively for a commercial enterprise; the sale of computer/computer peripherals to an insurance company. Makes various computer services for professions and occupations subject to the sales tax. |

| Adds exemptions | Specified digital products in relation to agriculture; period products and adult diapers from the sales tax; the sale of various computer services to a public utility. Effective January 2023. |

| Auto Rental | Strikes the auto rental excise tax exemption for peer-to-peer auto-sharing networks. |

| Food | Includes food sold for another purpose but that could be eaten by humans as food. Allows for refunds of taxes collected between 2019 and 2022, up to an aggregate cap of $100,000. |

| NG Pay | Exempts up to $20,000 in pay for drills and related matters. |

| Net Operating Loss | Allows taxpayers to deduct any remaining net operating loss from prior years after the repeal at the state level goes into effect. Limits the carryforward for in a year to 80% of net income. |

| Stock | Makes changes to employee stock purchases related to the changes in HF 2317 (Tax Reform signed last week). |

Tax III – Sales tax and IWILL

On Tuesday, another tax bill was introduced, (SSB3157) Tax III. This bill includes major provisions related to sales tax and the Iowa Water Land Legacy (IWILL) fund that was originally included in the Senate Tax Proposal introduced in week three (SF2206). The bill increases the state sales tax to 7%. It repeals the local option sales tax and transfers amounts to a fund for local government; requires local governments to use these sales tax monies for revenue purposes adopted by each city. Polk County is required to use at least 75% of the money received from the fund for property tax relief.

The bill also triggers IWILL by making changes to uses for a portion of the sales tax increase that will be deposited into the Natural Resources and Outdoor Recreation Trust Fund (IWILL). It establishes a formula for spending the monies in the trust including further the goals of nutrient reduction strategies and protecting existing public lands.

It is expected that both bills will receive further attention from the Senate, but unclear if either of these bills will become part of the major tax reform we have already seen this year.

Budget

This week we saw significant movement on budget bills, which is an indication leadership and legislators are working on the fiscal year 2023 budget in earnest.

The House introduced four appropriations bills (note these have not yet received file numbers):

| Agriculture and Natural Resources Appropriation | LSB 5001YA |

| Transportation Appropriation | LSB 5007YA |

| Justice System Appropriations | LSB 5005YA |

| Judicial Branch Appropriations | LSB 5006YA |

These appropriations bills moved through their respective Appropriations subcommittees on Thursday. We can expect committee action on these bills and further introduction of budget bills next week. The House has set its budget at $8.27 billion, slightly higher than the Governor or the Senate.

REC

The Revenue Estimating Conference (REC) met on Thursday for the scheduled March REC to provide an update on Iowa’s revenue (the legislature is statutorily required to utilize the lesser of the December or March REC when crafting their budgets).

Iowa’s revenue forecasters said Thursday they expect the state to bring in more money than expected in the current fiscal year, but that state revenue growth is expected to drop off and revenue will begin to decrease in the next two fiscal years.

The Revenue Estimating Conference is forecasting Iowa’s revenue will grow 4.2 percent this fiscal year to $9.17 billion. (Last fiscal year saw unusually high revenue growth of 11 percent.) Next fiscal year, which begins July 1, state revenue is expected to decrease by 0.2 percent. The following year, the REC estimates state revenue will decrease by 2.1 percent to $8.96 billion.

Revenue forecasters said Russia’s invasion of Ukraine as well as rising energy prices and inflation are causing more uncertainty in their estimates of Iowa’s revenue growth.

Iowa Department of Management Director Kraig Paulsen said the state is still in a strong financial position, and the Republican majority is planning a budget that’s a lot less than what they could spend. “I don’t foresee cuts to any services,” Paulsen said. “The reserve funds are full. The taxpayer relief fund at the end of this fiscal year is going to have close to $2 billion in it. So in the foreseeable future, no, I don’t really see any of those problems.”

For the next fiscal year, House Republicans are proposing spending $8.27 billion on the state budget, and Senate Republicans are proposing spending $8.2 billion. Both are far below the $9.17 billion in expected revenue.

Governor Reynolds released a statement on the REC estimate:

“The projections released today by the REC are very encouraging and again reaffirm why we worked hard this legislative session to pass the largest bipartisan tax reform bill in the history of our state. Our bold tax cuts were necessary as we continue to over-collect Iowan’s hard-earned money. But with the new tax law of a flat and fair 3.9% individual tax rate by 2026, and eliminating the state income tax on retirements, among other tax reform, Iowans will see more money in their pockets and not in the hands of the government. These new projections also reaffirm the fact that we have steady revenue entering our state, and that revenue will ensure that our key priority areas like education, public safety and mental health continue to be adequately funded.”

Representative Oldson, the ranking member on Appropriations, released a statement for House Democrats:

“Corporate Kim Reynolds is at it again. Iowa’s budget experts predicted a steep decline in state revenues next year just after hundreds of millions in new tax giveaways to corporations and millionaires were signed into law. While most Iowans won’t see another penny in their pocket for years, they instead will be paying more in property taxes and health care to pay for the GOP’s giveaways to corporations and millionaires. Every tax dollar Republican politicians hand over to corporations and millionaires costs Iowa families and puts the futures of more Iowa kids at risk.”

Election Update

March 18 is the deadline for candidates to file nomination papers with the Secretary of State for the June primary. At this time, at least two dozen House members and at least a dozen Senators have announced that they are retiring or plan to seek another elected office. We will provide a full summary of the primary races.

On Wednesday, Governor Kim Reynolds officially announced her 2022 reelection campaign at an event at the Iowa State Fairgrounds. If re-elected, this will be the Governor’s second full term as Governor.

Her announcement comes on the heels of signing historic tax reform into law and a week after delivering the Republican response to President Biden’s State of the Union Address. Governor Reynolds assumed office in 2017 when Governor Terry Branstad was appointed by President Trump to be the Ambassador to China. Governor Reynolds is the first female governor of Iowa and was elected as Governor in 2018 after successfully defeating Democratic challenger Fred Hubbell.

Deidre DeJear is currently the Democratic front-runner. Two other Democrats had previously announced their candidacy and have since withdrawn from the race. DeJear is a small business owner who previously ran for Secretary of State in 2018. She is the first Black woman in Iowa to be nominated by a major political party for a statewide office.

A recent Iowa Poll shows Gov. Kim Reynolds holds an 8-point lead over Democratic candidate Deidre DeJear.

What’s next?

- Second funnel deadline–Friday, March 18

- Filing deadline for the June primary — Friday, March 18

- Action on the FY 2023 will continue with the introduction of budget bills in both chambers

- Negotiations on policy priorities of legislative leadership and the Governor, including:

- Renewable Fuels

- Workforce

- Unemployment/Tort Reform

- Education Choice

- Further action on tax reform that was introduced this week

Under 40 days until April 19, the 100th Day of Session and the final scheduled day of the 2022 legislative session.