Week five was a shortened work week due to the Iowa midterm caucuses. Both parties held their caucuses around the state on Monday night. This is a chance for parties to set their platforms for upcoming elections and to meet the candidates running for office. The legislature delayed the start of week five so legislators to attend their local caucuses.

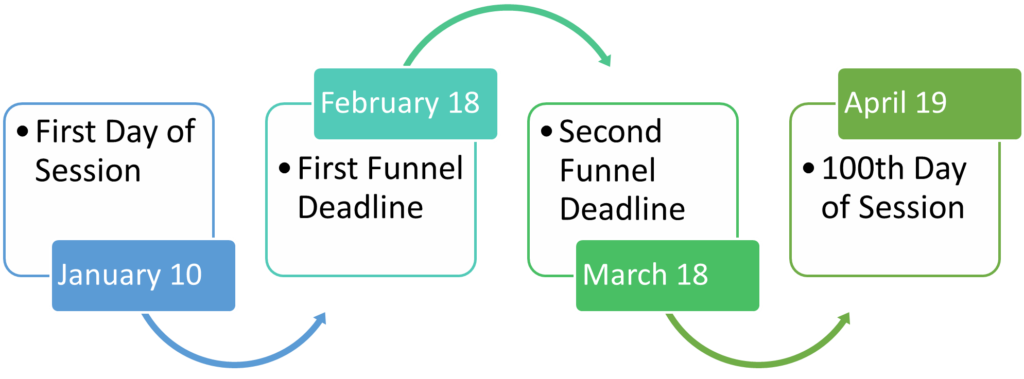

The loss of a legislative day was more than made up for in legislative action, scheduling over 175 subcommittees on bills over the shortened week. This pace is not uncommon for this time of year as next week brings the first milestone of the 2022 legislative session, the “First Funnel.” By next Friday, February 18, bills must be voted out of their committee of origin to be eligible for further action, with some exceptions for appropriations, tax, and leadership bills.

Policy Development Highlights

Education

Both the House and Senate Education Committees approved bills raising the School Supplemental Aid amount. On Thursday, the House took up and passed their SSA bill (HF 2316) on a 57-39 vote which includes a 2.5% increase (Governor’s recommendation). The House also took up and passed a School Supplemental funding bill (HF 2315). Total school aid in the House bills is about $179 million.

The Senate version of the SSA bill includes a 2.25% increase. The SSA difference ($150 million) and the supplemental funding ($19 million) is included in the overall budget negotiations taking place behind the scenes right now.

The SSA bill is typically provided to the Governor for her signature within the first 30-days of the legislative session.

Tax Reform

The Senate Ways & Means Committee approved the Senate tax proposal (now renumbered as SF 2206) on an 11-6 party-line vote last week, the bill is now eligible for floor debate.

The plan includes:

- 3.6% flat personal income tax phased in over 6 years

- 7.8% flat corporate rate

- Elimination of taxes on retirement income and expanded pay exemptions for Guard members.

- Exemption for either cash rent or farm crop shares for farmers

- Directs that the Taxpayer Relief Fund become the Income Tax Elimination Fund, to be used to reduce and eventually eliminate the income tax in Iowa.

- Full funding for IWILL (water quality funding)

- Makes the local option sales tax statewide

The House Ways & Means Committee voted out (HS B626) after a long debate on Tuesday on a 14-10 vote. The House bill does not include the corporate tax cuts, supported by Governor Reynolds and the Senate, or include provisions that would covert local option sales tax into a statewide sales tax like the Senate bill.

Renewable Fuels

The House took action on the Governor’s E-15 Program (HF 2128) approving the bill on the House floor. (HF 2128) is a priority of Governor Reynolds, requiring gasoline retailers to start selling higher blends of ethanol or to seek a waiver from the requirements. Last year, chambers were unable to reconcile their differences on a similar bill.

On Tuesday of this week, the Senate Agriculture Committee approved (HF 212) unanimously. The floor manager stated that this bill is about supporting Iowa and making the state more economically viable. The bill is now floor eligible in the Senate and has the potential to be the first bill sent down to the Governor for her signature this session.

Workforce

This week the Governor’s Workforce bill (SSB 3123) cleared the Senate State Government subcommittee. Action is expected on House companion (HSB 682) next week as it has been introduced and referred to the House Economic Growth Committee. The bill includes:

- Removal of zoning restrictions

- Work-based learning programs

- Health care workforce recruitment programs

- Professional licensing reform

- Veteran benefits

- Temporary insurance licensing

- State building code reform

What’s next?

Next week will see a wave of bill introductions and subcommittee meetings as well as committee meetings in which dozens of bills will pass so that they remain eligible for debate after next Friday, the first funnel deadline. Below is a graphic illustration of the legislative schedule. By the end of the week, there will only be two months left until the scheduled adjournment date.