Connecticut

As of April 1st

Data updates on testing in Connecticut

Since yesterday’s update, an additional 429 Connecticut residents have tested positive for COVID-19, bringing the statewide total to 3,557. To date, more than 16,600 tests have been conducted in Connecticut among both state and private laboratories. Approximately 766 patients have been hospitalized. The total statewide total number of fatalities is 85.

Among the new deaths to report is the first pediatric fatality linked to COVID-19 in Connecticut. This was a six-week-old baby in the Hartford area who was brought unresponsive to a Connecticut hospital late last week and could not be revived. Post-mortem testing confirmed last night that the newborn was COVID-19 positive.

“The passing of this newborn is absolutely heartbreaking,” Governor Lamont said. “We believe this is one of the youngest lives lost linked to COVID-19. This virus attacks our most fragile populations without mercy, and we will definitely see some hard days ahead. This also stresses the importance of staying home and limiting your exposure to other people. Your life and the lives of those you love could literally depend on it. Our prayers are with this family at this difficult time.”

A county-by-county breakdown includes:

| County | Laboratory Confirmed Cases | Hospitalized Cases | Deaths |

| Fairfield County | 1,986 | 359 | 46 |

| Hartford County | 469 | 126 | 11 |

| Litchfield County | 131 | 11 | 1 |

| Middlesex County | 66 | 8 | 2 |

| New Haven County | 611 | 251 | 15 |

| New London County | 29 | 10 | 1 |

| Tolland County | 61 | 1 | 7 |

| Windham County | 19 | 0 | 0 |

| Pending address validation | 185 | 0 | 2 |

| Total | 3,557 | 766 | 85 |

For several additional charts and tables containing more data groups, including a town-by-town breakdown of positive cases in each municipality and a breakdown of cases and deaths among age groups, click here.

Governor Lamont signs 20th executive order to mitigate the spread of COVID-19

Governor Lamont today signed another executive order – the 20th since he enacted the emergency declarations – that builds upon his efforts to encourage mitigation strategies that slow down transmission of the virus.

Governor Lamont’s Executive Order No. 7S enacts the following provisions:

- Safe stores mandatory

statewide rules: Effective upon the

opening of each retail establishment for the first time on April 3, 2020, every

retail establishment in the state will be required to take additional

protective measures to reduce the risk of transmission of COVID-19 between and

among customers, employees, and other persons such as delivery drivers and

maintenance people. The order requires the commissioner of the Economic and

Community Development to issue mandatory statewide rules prescribing such

additional protective measures. Such rules will be mandatory throughout the

state and supersede and preempt any current or contemplated municipal order.

- Immediately following Governor Lamont’s signing of this executive order, the Department of Economic and Community Development published the Safe Stores Rules on its website, outlining guidance for retail establishments. All stores must follow these rules beginning April 3.

- 60-day grace period for premium payments, policy cancellations, and non-renewals of insurance policies: Beginning on April 1, 2020 for a period of 60 days, no insurer in Connecticut – including life, health, auto property, casualty, and other types – may lapse or terminate a covered insurance policy because a policyholder does not pay a premium or interest during this time. This grace period is not automatic. To be eligible, affected policyholders must provide additional information acceptable to their insurance carriers.

- Extension of 30-day period of credit for liquor permittees: Modifies state law to permit the maximum period of credit for liquor permittees from certain creditors, including wholesalers and manufacturers, to be 90 days after the date of delivery for all permittees prohibited from engaging in on premise sales per Executive Order No. 7D.

- Daily payment of certain taxes changed to weekly: Modifies the tax payment requirements for Sportech, the licensee authorized to operate off-track betting in Connecticut, from daily to weekly so that its employees aren’t required to appear in person daily.

- Flexibility to amend Medicaid waivers and state plan: In order to allow continued access to critical services for Medicaid beneficiaries, the order waives public notice and legislative hearing requirements for the duration of the declared public health and civil preparedness emergencies to allow the Department of Social Services to seek expedited approval from the Centers for Medicare and Medicaid Services to submit Medicaid waivers; amend existing Medicaid waivers; submit Medicaid State Plan Amendments that would have required a waiver but for the Affordable Care Act; and obtain relief from various other federal requirements on an emergency basis.

- Relief from certain municipal tax deadlines and collection efforts: Requires municipalities to enact one or both of two options for providing temporary tax forbearance of property tax collection and reduced interest on delinquent tax payments to property owners under certain conditions, including that landlords agree extend commensurate forbearance to commercial, residential, or institutional tenants for the duration of the deferment.

- Allow suspension of in-person voting requirements for critical and time sensitive municipal fiscal deadlines: Allows suspension of certain in-person votes of residents or taxpayers on certain fiscal decisions, in addition to the provisions in Executive Order No. 7I, for fiscal decisions needed to prevent property damage, protect public health and safety, or prevent significant financial loss, provided they comply with all open meeting requirements of Executive Order No. 7B.

- Suspension of reapplication filing requirement for the homeowners’ elderly/disabled circuit breaker tax relief program and for the homeowners’ elderly/disabled freeze tax relief program: Allows recipients of this benefit to receive the benefit for the coming year without recertifying their eligibility.

- Substitution of full inspection requirements pertaining to October 1, 2020 grand list revaluations: Allows 34 municipalities to continue with their scheduled 2020 revaluations, which are started up to a year in advance. The statute allows for Data Mailer Questionnaire to be mailed to the property owner when access is unobtainable; this eliminates having to request access, and allows for the revaluation to be completed via questionnaire.

- Extension of deadline to file income and expense statement to August 15: Allows taxpayers additional time to complete their income and expense statements.

- Suspension of non-judicial tax sales: Suspends foreclosures through non-judicial tax sales until 30 days after the end of the COVID-19 emergency.

Kansas

As of March 31st

The governor just enacted another Executive Order this evening, as the COVID-19 pandemic continues. Primarily, the EO relates to unemployment insurance requirements. The full order can be found here.

Georgia

As of April 2nd

- Governor Kemp announced this afternoon that school closures will last for the rest of this school year. Gov. Kemp will issue an Order tomorrow starting a state-wide shelter through April 13.

- Per covid19.healthdata.org, it is anticipated that Georgia will have a shortage of 594 beds and 755 ICU beds with a peak on April 22 with 84 deaths on April 23.

- Allegedly, at least 47 long-term facilities in GA have COVID-19 outbreaks

- Georgia has between 2,400 – 3000 ventilators.

Daily State Public Health stats:

- State cases are up to 5,348 at noon today as compared to 4,748 on Wednesday at 7 p.m. Georgia is now up to 163 deaths up from 154 at 7 p.m. Wednesday. 1,056 confirmed patients are hospitalized as compared to 1013 at 7 p.m. Wednesday.

- Dougherty, Fulton and Cobb Counties have the most cases in Georgia.

North Carolina

As of March 31st

Mid-Week Update

Three new Executive Orders issued, North Carolina Department of Revenue Tax Relief Notice and updates to local actions.

- Executive Order 122, Donation or Transfer of State Surplus Property, March 30th authorizing the disposal of surplus state property to any agency, political subdivision or school system in the state.

- Executive Order 123 Extending NC Early Childhood Advisory Council, March 31st amends previously issued EO to extend council past sunset date.

- Executive Order 124, Utility Shut-offs, Evictions, Other Business Considerations, March 31st Prohibiting utility shut-off, late fees reconnection fees; guidance regarding evictions; encouraging other businesses to provide assistance and flexibility to customers.

- NCDOR Expanded Penalty Relief Notice, March 31st expands tax relief for individuals and businesses.

Also this Week

On Monday, Executive Order 121, Gov. Cooper’s Stay at Home order, went into effect. During his Tuesday press conference, the Governor stressed the importance of following the guidelines the order lays out. As of Tuesday, North Carolina reported another 191 cases of coronavirus, bringing the state’s total to 1,498 with 8 deaths (two deaths were residents of Virginia traveling through North Carolina). The number of people hospitalized from the virus has grown to more than 135 and the median age for those who tested positive in NC is 46. DHHS Secretary Mandy Cohen said that the state expects there to be a confirmed case in all 100 North Carolina counties in the coming days, or at least by the end of the week. Cohen also said that North Carolina has just received its third stockpile of much-needed supplies — including N95 masks, gloves, face shields and gowns — from the Strategic National Stockpile.

North Carolina’s new stay-at-home order won’t show any conclusive effect on blunting the intensity of the new coronavirus for about two weeks, according to the state epidemiologist. The incubation time between an individual being exposed to COVID-19 and getting sick can be up to 14 days, with an average of five to seven days. The uptick in laboratory-confirmed cases or other illness surveillance in the next several days will likely reflect the period before movement rules were put in place.

Governor Cooper signed an order Monday giving surplus property owned by the state to health care workers, schools and local governments to help them with the coronavirus pandemic and its impact. Items include personal protective equipment and computers. The order states that those items could be given to state agencies, first responders and schools.

On Tuesday, North Carolina Governor Roy Cooper signed an additional executive order to prohibit utility companies from shutting off services to people who are unable to pay. The order states that electric, gas, water and wastewater services cannot be shut off for the next 60 days. It also encourages banks not to charge customers overdraft fees, late fees and other penalties. In addition, Gov. Cooper said that telecommunications companies that provide phone, cable and internet services are “strongly urged to follow these same rules.” Cooper added that many companies have already committed to follow these guidelines even before the order was signed. He said there were too many companies to name, but commends them all for doing the right thing.

The North Carolina Department of Justice has temporarily stopped all its debt collection programs that attempt to recover a wide variety of overdue fees and payments to state government. The department will not issue demand letters or continue other debt collection activities for agencies including the Department of Environmental Quality, the University of North Carolina system, the Department of Health and Human Services and the Department of Transportation. The collections range from environmental permitting fees to university student tuition to parking tickets.

The North Carolina Department of Revenue closed its headquarters Monday after learning an employee tested positive for COVID-19. A department news release said the employee is based in the Raleigh headquarters and was last in the building on March 21. Department officials said a large number of their employees were already working remotely. The building will undergo a thorough cleaning before reopening to on-site employees.

In other Department of Revenue news, North Carolinians and businesses worried about paying their taxes this spring will get more relief. Plus, state lawmakers from both parties, including the governor, support passing a new law to waive interest on late tax payments. Secretary of Revenue Ronald G. Penny announced Tuesday that the state is expanding tax relief as part of Governor Cooper’s response to the COVID-19 pandemic. The state is already following the Internal Revenue Service’s lead in extending deadlines for both filing and payments for income taxes from April 15 to July 15.

There will be no penalties for late filing or payment of North Carolina sales and use and withholding taxes through July 15. Already announced by the state are no penalties for late filings and payments of individuals, corporations, partnerships, trusts and estates. There will be no penalties for failure to obtain a license, failure to file a return or failure to pay a tax that is due from March 15 through July 15. Other tax penalties will be waived if paid by July 15 for withholding tax, sales and use tax, scrap tire disposal tax, white goods disposal tax, motor vehicle lease and subscription tax, solid waste disposal tax, 911 Service Charge for Prepaid Telecommunications Service, dry-cleaning solvent tax, primary forest products tax and freight car line companies. A full list is available here.

While the late fees will be waived, taxpayers could still end up paying interest unless state lawmakers take action. Waiving interest from tax due dates cannot be changed by North Carolina Department of Revenue because of state law. The General Assembly would have to pass a bill, which the governor would have to sign, to make that happen. The current interest rate on late payments is 5 percent a year. State leaders from both political parties have said they want to add the interest waiver to tax relief plans.

North Carolina’s farmers are battling the global coronavirus pandemic, as the coronavirus is affecting their most important asset: the seasonal workforce imported from Mexico and elsewhere in Latin America. Those migrant workers, according to advocates, are a vulnerable population who could feel compelled to work on North Carolina’s farms — whether or not their employers have taken steps to keep them safe.

As a major effort to reduce virus spread, the State Department had announced on March 17 that all routine visa processes in US embassies in Mexico would be suspended, allowing H-2A visas only for returning farmworkers who were issued them last year. This prompted local and federal lawmakers nationwide to speak out against the expected labor shortage from the absence of new, first-time workers. The State Department rescinded its decision on March 27 to allow for more non-US farmworkers to work American fields. While this helps the state and rest of the nation to avoid interruptions to food supply chains, the tens of thousands of seasonal farmworkers who will work Carolinian fields this season are at risk of exposure to COVID-19. “The guidance for the general public right now is to use social distancing and keeping distance from everybody, and so, for the case of farmworkers residing in labor camps, that’s basically impossible,” said Dr. Elizabeth Freeman Lambar of the North Carolina Farmworker Health Program within the state’s Department of Health and Human Services. The vast majority of H-2A farmworkers share sleeping quarters, kitchens and bathrooms in barracks, old farmhouses and trailers provided to them by growers. Those who are US residents and follow seasons around different states, known specifically as “migrant” farmworkers, often live with their families. “The ability to minimize the risk of exposure is really difficult for farmworkers. “

The North Carolina Growers Association, in charge of bringing thousands of workers from Mexico, stated that they are abiding by Department of Health and Human Services guidelines which instruct farmers to quarantine sick workers and let them rest until they recover. The Association remains optimistic about the measures that will be taken to guard workers’ health and in turn, guard the flow of agricultural labor. The association said that it was up to each individual farmer to provide adequate housing and alternatives if quarantine is necessary. “If the grower has sufficient housing to isolate that individual with his housing, then we’ll do that,” a Growers Association official said. “If not, we’ll have to look at hotels or other housing.” The association stated they would pay for that housing. Asked about a health protocol in the wake of the evolving pandemic, the association said they do not have one that could be shared.

The North Carolina Medical Board voted last Friday to relax some regulations in an effort to make more doctors and medical professionals available to fight coronavirus. The board is postponing certain testing requirements that medical students typically must meet before beginning a residency program, as long as they have still completed medical school graduation requirements. Another action by the board will make it easier for healthcare organizations to reassign physician assistants to other practice areas. call to increase the supply of qualified medical professionals available to help. Also last Friday, the Medical Board approved new rules that it said will “reduce the occurrence of reported stockpiling or inappropriate prescribing of chloroquine, azithromycin and other medications, and ensure that these drugs are available to patients who need them.” Those are medications that some have suggested might treat coronavirus, but are essential for other conditions.

While national insurers are announcing they will waive copay and deductibles tied to COVID-19 treatments, the state’s largest insurer, Blue Cross and Blue Shield of North Carolina, says it is still reviewing options and looking for the best ways to serve its 3.8 million North Carolina customers. In response to a question about whether the company would be waiving treatment costs, Blue Cross officials saidthat the situation is “constantly changing” and it is “continually monitoring how to best serve our members in the face of COVID-19.”The statement comes just days after two of the country’s largest insurers – Humana and Cigna – announced they would cover the co-pay and deductibles for COVID-19 patients, including hospitalizations. Blue Cross did not directly respond to whether it was considering the same.

Executive Actions, Week of March 30th

- Executive Order 121, Statewide Stay at Home Order, March 27th becomes effective Monday, March 30.

- Statewide Stay at Home Order, FAQ

- Executive Order 122, Donation or Transfer of State Surplus Property, March 30th authorizing the disposal of surplus state property to any agency, political subdivision or school system in the state.

- Executive Order 123 Extending NC Early Childhood Advisory Council, March 31st amends previously issued EO to extend council past sunset date.

- Executive Order 124, Utility Shut-offs, Evictions, Other Business Considerations, March 31st Prohibiting utility shut-off, late fees reconnection fees; guidance regarding evictions; encouraging other businesses to provide assistance and flexibility to customers.

- NCDOR Expanded Penalty Relief Notice, March 31st expands tax relief for individuals and businesses.

- NC Economic Development Partnership – Small Business Resources

Local Government Actions

- Pitt County Stay at Home Order, March 23

- Graham County and Municipalities Non-Resident Access Permit & Curfew, March 23

- Town of Beaufort Stay at Home Order, March 23

- Brunswick County State of Emergency, March 24

- Columbus County State of Emergency, March 24

- Mecklenburg County and Municipalities Stay at Home Order, March 24

- City of Durham Stay at Home Order, March 25

- Greensboro, Guilford County, High Point Stay at Home Order, March 25

- Buncombe County Stay at Home Order, March 26

- Cabarrus County and Municipalities Stay at Home Order, March 26

- Gaston County and Municipalities Stay at Home Order, March 26

- Haywood County Stay at Home Order, March 26

- Wake County and Municipalities Stay at Home Order, March 26

- City of Winston-Salem Stay at Home Order, March 26

- Village of Clemmons Shelter in Place Order, March 26

- City of Lexington Stay at Home Order and Curfew, March 27

- Madison County and Municipalities Stay at Home Order, March 27

- Rutherford County and Municipalities Stay at Home Order, March 27

- New Hanover County State of Emergency, March 28

- Watauga County and Municipalities State of Emergency, March 30

- City of Fayetteville State of Emergency and Curfew, March 31st

Relevant Articles

- Soaring Unemployment Claims in NC Revive a Contentious Debate on Benefits Policy

- GoTriangle Bus Driver Worked for Days While Sick

- Relief Fund for NC Hospitality Industry Seeks Donations – 7,000+ Applications Already Filed

Oregon

As of April 1st

The big news today is this afternoon’s issuance of Executive Order 20-13, which places a 90-day moratorium on commercial evictions for nonpayment; strengthens the Governor’s previous ban on residential evictions; and prohibits landlords from charging renters late fees for nonpayment of rent during the moratorium.

We’re also following when special session will be scheduled; providing some information on upcoming town halls with Sens. Merkley and Wyden; and reading about how things are going in Portland via an interview with Mayor Wheeler. All that and more below!

State Updates:

- Moratorium on commercial evictions, strengthened ban on residential evictions: Governor Kate Brown issued Executive Order 20-13 today, which temporarily bans commercial evictions and strengthens the moratorium on residential evictions. Read the full order here.

- Senate President says “not this week” for special session: Yesterday evening, The Oregonian quoted Senate President Peter Courtney as saying that lawmakers “won’t have a special session this week” to vote on the 15 proposals from the Joint Special Committee on Coronavirus Response. Sen. Courtney added that “there’s some speculation [Governor Brown will] wait until the [May 20 state tax revenue] forecast.” So, hang tight, and we’ll keep you posted.

- DCBS releases FAQ on coronavirus emergency order: On March 25, DCBS issued an emergency order that required “all insurance companies to postpone policy cancellations and non-renewals, extend grace periods for premium payments, and extend deadlines for reporting claims.” They have now posted an extensive FAQ, should you have any questions or concerns.

Local Updates:

- Mayor Wheeler interview with Willamette Week: Portland Mayor Ted Wheeler did a five question interview with Willamette Week out today, on the state of the city post-shutdown. He discusses how the stay-at-home order is going; support for people who can’t make mortgage payments; implementation of CARES Act funds; and the state of the city budget, which is projected to take a General Fund hit of US$40-100 million in the next fiscal year.

COVID-19 Update:

- Oregon now has 736 confirmed cases and 19 reported deaths as of 8:00 am April 1 (up 46 cases since March 31).

Oregon News Related to COVID-19

Nonprofits & Small Businesses

- FREE social media graphics related to COVID-19

- The Oregon Community Recovery Grant program will provide funds to nonprofit organizations in Oregon that are particularly affected by the outbreak of COVID-19. Learn more here.

- For Portland businesses, the Small Business Relief Fund through Prosper Portland began accepting applications today for grants and loans for small businesses who have been negatively impacted by COVID-19. Prosper Portland also has COVID-19 business resources.

- The US Small Business Administration is providing Disaster Assistance Loans for small businesses

- Greater Portland, Inc. digest of resources for businesses

CARES Act

- Senate Appropriations Committee overview on CARES Act

- New York Times FAQ on stimulus checks, unemployment, and the CARES Act

General Resources

- Governor Kate Brown’s resource page

- Oregon Health Authority (OHA) COVID-19 resource page

- OPB’s helpful overview of the Joint Special Committee on Coronavirus Response proposals can be found here.

Tennessee

As of March 30th

The total number of positive cases in the state stands at 1,834 with the most cases now in Shelby County (Memphis-396) followed by Davidson County (Nashville-364). There are 13 confirmed deaths in the state. The COVID-19 Unified Command, which includes the Departments of Health and Military and TEMA, created a new website here.

Health Response

Today, Governor Lee issued Executive Order 22 which directs Tennesseans to stay at home unless engaging in essential activities. This also includes the closure of businesses and organizations that are not deemed essential. The Governor stressed that this order is not a “shelter in place” order, but strongly urges limited activity outside of the home. Those businesses deemed essential “should take steps to the greatest extent practicable to equip and permit employees to work from home, and employees and their customers should practice good hygiene…”

A list of businesses deemed “essential” can be found here.

Last week, Gov. Lee signed Executive Order 20 to ensure Tennessee can further mobilize health care workers to fight COVID-19. The executive order loosens restrictions around retired medical professionals, temporarily suspends continuing education requirements, and expands telemedicine efforts so that all licensed providers may utilize telemedicine during COVID-19 as long as they are practicing within their normal scope of practice.

Also today, the Tennessee Department of Health indicated that 67 percent of traditional ventilators are available for use across the state’s hospitals.

Economic Response

For the week ending March 21, 2020, Tennesseans filed 39,096 initial claims for unemployment insurance benefits. The week prior, the state received 2,702 new unemployment claims. The latest figure represents a nearly 20 fold increase in week-to-week claims. The vast majority of new claims have come from northern Middle Tennessee.

The state is spearheading a public-private partnership to create the Tennessee Talent Exchange powered by Jobs4TN.gov. The goal of the exchange is to quickly match Tennesseans who are out of work due to COVID-19 with companies currently experiencing a surge in business and making immediate hires, like grocery stores and logistics companies. The Department of Labor & Workforce Development has modified the state’s workforce development website to quickly post job openings and match job seekers with employers.

Cities’ Response

Over the weekend, at least 74 residents at a Gallatin nursing home have tested positive for COVID-19. Two of those individuals have died. Additionally, 33 members of the Gallatin Center staff have tested positive and are now isolated at home. Nursing home residents and staff were taken to the hospital in two large evacuations, each taking several hours to conduct. On Friday, 23 residents were transported to Sumner Regional Medical Center. The state mobilized to arrange the transport of the residents through an ambulance strike team of EMS professionals from multiple jurisdictions. On Saturday, more than 20 National Guard personnel were deployed to the nursing home to assist the Center with COVID-19 testing for all residents and staff. Gallatin is in Sumner County and about 30 miles northeast of Nashville. Two weeks ago, Sumner County had one confirmed case. Today, they have 164 confirmed cases.

In Memphis on Thursday, the head of epidemiology for Shelby County, said stay-in-place orders are helping with the spread, but the county has not reached its plateau of cases yet. Today, the Mayor of Memphis announced that beginning at 8 a.m. Tuesday, March 31, the city is limiting access to city parks.

In Chattanooga today, Mayor Andy Berke announced the COVID-19 Small Business Stabilization Fund (CSBSF).This fund will provide short-term working capital to businesses that are facing sudden and severe revenue shortfalls. The City has committed US$2.5 million to set up grant and loan programs that can help businesses in different ways — short-term rental assistance, continued payroll for displaced workers, or larger business expansion needs.

Texas

As of March 31st

Governor Abbott has a news conference moments ago in Austin with Lt Gov Dan Patrick, Speaker Dennis Bonnen, Dr. John Hellerstadt (DSHS) and Chief Nim Kidd.

Gov. Abbott expanded/tightened his March 19 social distancing order, which closed schools, bars, dine-in restaurants, gyms, salons, tattoo parlors and the like. Today’s executive order (attached), provides exemptions for “Essential services” consist[ing] of everything listed by the US Department of Homeland Security in its Guidance on the Essential Critical Infrastructure Workforce, Version 2.0, plus religious services conducted in churches, congregations, and houses of worship. Other essential services may be added to this list with the approval of the Texas Division of Emergency Management (TDEM). TDEM shall maintain an online list of essential services, as specified in this executive order and in any approved additions. Requests for additions should be directed to TDEM at EssentialServices@tdem.texas.gov or by visiting www.tdem.texas.gov/essential services.”

It goes on to say:

This executive order does not prohibit people from accessing essential services or engaging in essential daily activities, such as going to the grocery store or gas station, providing or obtaining other essential services, visiting parks, hunting or fishing, or engaging in physical activity like jogging or bicycling, so long as the necessary precautions are maintained to reduce the transmission of COVID-19 and to minimize in- person contact with people who are not in the same household.

In accordance with the Guidelines from the President and the CDC, people shall not visit nursing homes, state supported living centers, assisted living facilities, or long-term care facilities unless to provide critical assistance as determined through guidance from the Texas Health and Human Services Commission.

“In accordance with the Guidelines from the President and the CDC, schools shall remain temporarily closed to in-person classroom attendance and shall not recommence before May 4, 2020.”

Virginia

As of April 1st

Virginia Gov. Ralph Northam acknowledged that he is gathering input on whether adjustments are needed to multiple business-oriented legislative proposals approved by the General Assembly before the COVID-19 pandemic brought the state, national and global economies to a standstill.

Those bills – including measures to hike the minimum wage and empower local government to allow public employees to engage in collective bargaining – represented landmark achievements for Democrats, who assumed full control this year of the legislative and executive branches for the first time in more than 25 years.

At a press conference Wednesday to discuss the latest on the COVID-19 pandemic, Northam said he is having discussions with business and labor groups, as well as delegates and senators, about the impacts of the bills ahead of his April 11 veto deadline.

Northam also said municipal elections in May and congressional primaries in June will go on as scheduled, and he said he will encourage Virginians to vote by absentee ballot. He described the elections as fundamental and essential democratic exercises.

The governor also noted that the US Army Corps of Engineers had reviewed 41 potential field hospital sites across Virginia and narrowed that list to sites in Fairfax, Hampton and the Richmond area. While Virginia has received a third shipment of additional personal protective equipment from the national stockpile, Northam said more is needed.

As of April 1, Virginia had recorded 1,484 positive cases of COVID-19, with 208 patients hospitalized and 34 deaths. Northam said the outbreak is expected to peak between late April and late May in Virginia.

Northam’s finance secretary, Aubrey Layne, sidestepped questions pertaining to public budget impacts and deferral of tax collections. The economic crisis, he said, would be dealt with after the public health crisis is under control.

Virginia remains under a statewide stay-at-home order until June 10. Public schools are closed through the rest of the academic year; colleges and universities have transitioned to online instruction; correctional facilities have suspended visitation; most entertainment and recreational activities and businesses have been shut down; and restaurants and breweries have had to shift to delivery or drive-through to serve the public.

Northam plans to hold another press conference on Friday.

West Virginia

As of April 1st

West Virginia Governor Jim Justice announced that they are going to move the West Virginia Primary Election to June 9 instead of May 12. He also said that West Virginia Schools will be closed until at least April 30. The previous date was April 20.

Wisconsin

As of April 2nd

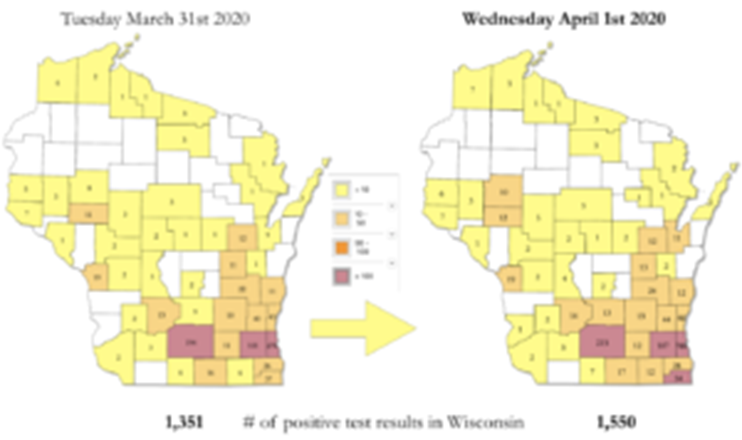

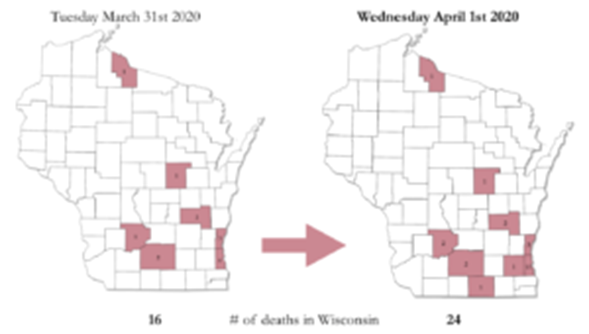

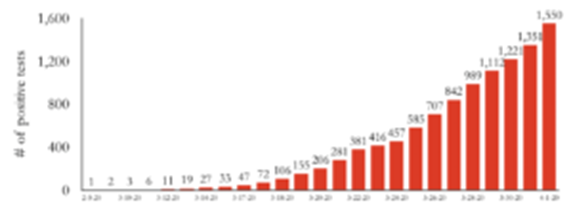

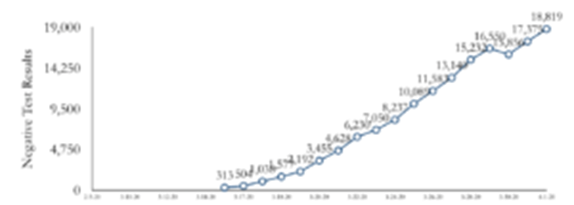

On Wednesday afternoon, DHS released updated numbers on test results in Wisconsin:

- The number of positive cases is up to 1,550 in Wisconsin, up 199 from 1351 in Tuesday’s update.

- 18,819 negative test results (17,375 negative test results were reported on Tuesday).

- 24 patients have died in Wisconsin (16 deaths were reported on Tuesday)

Please note this date is taken from the 2 p.m. daily data reporting on the DHS COVID-19 Outbreak page. Several Wisconsin media outlets are reporting more rapidly updated information that they are pooling directly from the various county health departments. We will continue to use the DHS data for our updates, but wanted you to be aware of the variation in data and sources.

Governor Evers releases second package of COVID-19 related proposals

As negotiations between the Evers Administration and Legislative leaders continues on state action related to the COVID-19 health crisis, Governor Tony Evers announced “a second package of comprehensive legislative proposals that would provide critical investments in health services, support for essential workers, and assistance for Wisconsin families and businesses in response to the COVID-19 pandemic.” This 2nd group of proposals is be viewed as “in addition” to the previous requests that were announced over the weekend.

According to a summary by the Governor’s Office, the second proposal (linked here) contains the following proposals, among others:

- Increasing funding for Medicaid providers via supplemental payments and rate increases to support the healthcare system’s response to the public health emergency;

- Establishing a fund to reduce providers’ uncompensated care costs targeting reimbursement for treatment-related costs for uninsured individuals;

- Establishing a COVID-19 reinsurance program to reduce health insurance premiums;

- Providing grant funding to provide food assistance and meal delivery;

- Prohibiting utility cooperatives from disconnecting customers and prohibiting land-lord directed disconnections from rental units during a public health emergency;

- Ensuring workers receive back payment for any lost unemployment insurance benefits as a result of the delay in suspending the one-week waiting period;

- Providing supplemental payments to child care providers, if that provider needed to shut down during the public health emergency;

- Allowing households to apply for heating assistance under the low-income energy assistance program anytime during the 2020 calendar year;

- Increasing the Earned Income Tax Credit for low-income families;

- Providing municipalities the flexibility to implement multiple installments of three or more payments for 2020 property taxes;

- Waiving interest and penalties on delinquent property taxes included in the 2019 payable 2020 tax roll, on and after April 1, 2020;

- Creating a fund through the Wisconsin Housing and Economic Development Association to provide 6 months of support for prevention of single-family foreclosures and providing refinancing opportunities to current borrowers; and

- Providing grant funding for small businesses and workers through the Wisconsin Economic Development Corporation.

LFB Memo on State Funding Under CARES Act

The Legislative Fiscal Bureau (LFB) released a memo to the State Legislature that addresses the fiscal effects of the CARES Act and the potential impact that it may have on Wisconsin government and in some instances, local governments and educational institutions. The memo includes a brief description of the provisions of the federal legislation and the funding that may be received under each item. LFB Director Bob Lang notes that, “In some instances, it has not yet been determined what the state’s share of the funding will be. If an estimated fiscal effect is available, it will be indicated in the summary of the provision.” Director Lang in the memo also noted “that although this memorandum describes provisions of the federal legislation based upon materials currently available, the administration of and funding of the Act will be known once guidelines from the federal government have been promulgated.” (Link to Memo)

Number of Positive Results by County

*Note previous Negative Test Result data released by DHS may have contained duplicative data or data related to out of state patients. We will clean up the chart as soon as DHS releases the updated information.

Previous Wisconsin COVID-19 Updates

Previous COVID-19 Updates are archived here.

Click here for a comprehensive list of State of Wisconsin resources related to the public health emergency.